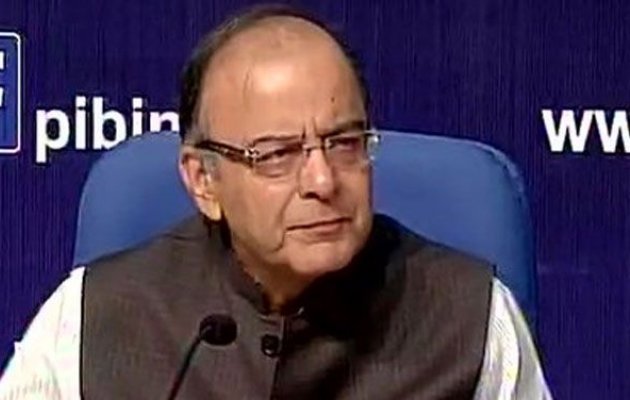

New Delhi, Dec 17: Finance Minister Arun Jaitley has hinted at accepting Congress’ stand on scrapping of one per cent additional tax but said that their demand for incorporating the GST rate in the Constitution Bill was not agreeable.

Congress has been stalling passage of the GST Bill over its demand for a simple Goods & Services Tax (GST) regime where states do not have powers to levy additional tax over a 18 per cent tax rate that forms part of the Constitutional Amendment Bill.

Speaking at an industry meet on GST, he said the one per cent additional tax on inter-state sales was proposed as manufacturing states like Gujarat and Tamil Nadu were of the opinion that they, having spent money on putting up infrastructure, would lose on revenue as GST is more of a destination tax.

GST is to subsume all indirect taxes like excise duty, sales tax and service tax. In the new regime, there will be one Central GST or C-GST and State GST or S-GST.

Currently, states levy sales tax or VAT on goods sold within their state and they get a Central Sales Tax (CST) on sales made outside their territories.

This CST will no longer be available in the new regime and a one per cent additional tax was proposed to make up for it.