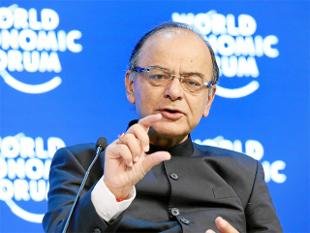

New Delhi, Jan 25: Ahead of the Budget 2016-17, Finance Minister Arun Jaitley said on Monday that the government is looking into the recommendations of Parthasarathi Shome committee for simplifying tax administration.

“The Shome Committee report has given several recommendations which we are at a very advanced stage of looking into. It has suggested certain reforms in tax administration,” he said addressing the Platinum Jubilee celebrations of Income Tax Appellate Tribunal here.

Jaitley said a committee has also been set up under Justice R V Easwar to simplify the the Income Tax Act. “Laws must be simple, so even if you have a large number of assessees and you have a large number of population, if your laws are simple, then the possibility of excessive litigation itself does not arise,” Jaitley added.

Referring to his last Budget proposal of reducing corporate tax from 30 per cent to 25 per cent over 4 years along with removal of tax exemptions, Jaitley said it would make the tax system cleaner and simpler and will ensure that “oppressive taxmen does not hover over us”.

The Tax Administration Reform Commission (TARC), headed by Shome, had in its report pitched for a separate budget allocation to ensure time bound tax refund and a passbook scheme for TDS (Tax Deduction at Source).

It had suggested that retrospective amendments to tax laws should be avoided as a principle and Income Tax Return forms should also include wealth tax details.

Recommending far-reaching reforms in tax administration, the panel had suggested abolition of the post of Revenue Secretary, merger of CBDT and CBEC and broadening the use of Permanent Account Number (PAN). The TARC submitted report to Jaitley in June 2014.

The Easwar Committee, in its draft report released last week, had recommended an across-the-board raising of threshold limits for TDS and halving of the withholding tax in most cases.

It also suggested a 12 per cent or 18 per cent interest on delayed refunds.